mississippi income tax rate

There is no tax schedule for Mississippi income taxes. Single married filing separate.

Where S My State Refund Track Your Refund In Every State

These rates are the same for individuals and businesses.

. Mississippi Income Tax Rate 2020 - 2021. Mississippi Capital Gains Tax. Box 23050 Jackson MS 39225-3050.

The Mississippi corporate tax rate is changing. Mississippi has a graduated tax rate. Reduce the state grocery tax from 7 to 5 starting in July.

In subsequent years the Magnolia State would effectively impose a flat tax of 5 percent on all taxable income over. 2021 Tax Year Return Calculator in 2022. Mississippi will follow the extended federal due date of February 15 2022 extended from January 3 to file certain income tax returns for victims of Hurricane Ida.

Mississippi has a graduated tax rate. This would mean people would pay no state income tax on their first 26600 of income a savings of about 50 a year. Detailed Mississippi state income.

Mississippi has a graduated tax rate. TurboTax Makes It Easy To Get Your Taxes Done Right. 15 Tax Calculators 15 Tax Calculators.

These rates are the same for individuals and businesses. When coupled with the 3 percent marginal rate repeal which was fully eliminated at the start of 2022 the Senates bill would result in Mississippi levying no tax on the first 100000 of taxable income by calendar year 2026. No Tax Knowledge Needed.

If you are receiving a refund PO. The Mississippi tax rate and tax brackets are unchanged from last year. Mississippi has a graduated income tax rate and is computed as follows.

Ad Answer Simple Questions About Your Life And We Do The Rest. Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at least 2001. DATEucator - Your 2022 Tax Refund Date.

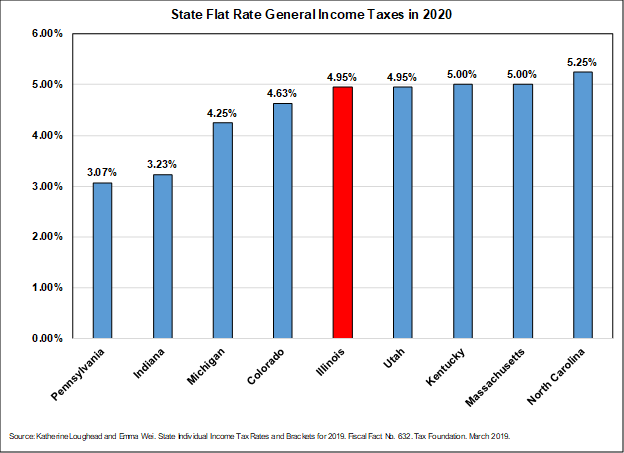

Mississippi Governor Tate Reeves R in his budget proposal for fiscal year FY 2022 has announced his goal of phasing out the states income tax by 2030. 4 on the next 5000 of taxable income. Mississippi has an opportunity to become the 10th state without an individual income tax and to do so with sales tax rates which while certainly high are in line with regional competitors.

Mississippi personal income tax rates. Discover Helpful Information and Resources on Taxes From AARP. The updated relief covers the entire state of Mississippi and applies to any individual income tax returns.

For an in-depth comparison try using. Title 27 Chapter 7 Mississippi Code Annotated 27-7-1 S Corporation Income Tax Laws. Box 23058 Jackson MS 39225-3058.

There is no tax schedule for Mississippi income taxes. For such a momentous undertaking however policymakers should be equipped with reliable revenue projections and a detailed accounting of how much revenue is projected to. Provide up to a 5 one-time income tax rebate in 2022 for those who paid taxes.

Diesel fuel faces the same low tax of 18 cents per gallon. In general Mississippi businesses are subject to. All other income tax returns P.

Mississippi state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with MS tax rates of 0 3 4 and 5 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. Mississippis maximum marginal corporate income tax rate is the 3rd lowest in the United States ranking directly below North Dakotas 5200. 3 on the next 3000 of taxable income.

The graduated income tax rate is. Mississippi Gas Tax. 0 on the first 3000 of taxable income.

Regular gasoline in Mississippi is taxed at a rate of 18 cents per gallon one of the lowest gas taxes in the country. Currently the corporate income tax rates are 3 percent for the first 5000 4 percent for the next 5000 and 5 percent on anything beyond 10000. The rebates would range from 100 to 1000.

Your 2021 Tax Bracket to See Whats Been Adjusted. As you can see your income in Mississippi is taxed at different rates within the given tax brackets. 5 on all taxable income over 10000.

Each marginal rate only applies to earnings within the applicable marginal tax. 3 on the next 2000 of taxable income. Any income over 10000 would be taxes at the highest rate of 5.

Mississippi has three marginal tax brackets ranging from 3 the lowest Mississippi tax bracket to 5 the highest Mississippi tax bracket. Mississippi Code at Lexis Publishing. For income taxes in all fifty states see the income tax by state.

File With Confidence Today. For more information about the income tax in these states visit the Illinois and Mississippi income tax pages. However gains from the.

These rates are the same for individuals and businesses. Title 27 Chapter 8 Mississippi Code Annotated 27-8-1 Corporate Franchise Tax Laws. Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5000 spread across three tax brackets.

The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. Mississippis income tax currently has three marginal rates of 3 percent 4 percent and 5 percent. Ad Compare Your 2022 Tax Bracket vs.

Title 27 Chapter 13 Mississippi Code Annotated 27-13-1. Short- and long-term capital gains are taxed at the regular income tax rates in Mississippi. 0 on the first 2000 of taxable income.

It S All About The Context A Closer Look At Arkansas S Income Tax Arkansas Advocates For Children And Families Aacf

State Income Tax Rates And Brackets 2022 Tax Foundation

Mississippi Tax Rate H R Block

Individual Income Tax Structures In Selected States The Civic Federation

Mississippi Income Tax Calculator Smartasset

Tax Rates Exemptions Deductions Dor

The Most And Least Tax Friendly Us States

Strengthening Mississippi S Income Tax Hope Policy Institute

States With Highest And Lowest Sales Tax Rates

Mississippi Tax Rate H R Block

Mississippi Income Tax Calculator Smartasset

Mississippi Sales Tax Small Business Guide Truic

Historical Mississippi Tax Policy Information Ballotpedia

Tax Rates Exemptions Deductions Dor

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Mississippi Tax Forms And Instructions For 2021 Form 80 105

Mississippi Income Tax Brackets 2020

Mississippi House Votes To Repeal Income Tax Picayune Item Picayune Item

Eliminating The State Income Tax Would Wreak Havoc On Mississippi Itep